This excel template allows you to prepare one, and you can also view an example and read up how it works. It allows you to enter in all the bills coming up with their due date, enter in the daily bank balance, enter in the income and calculate how much you have available to pay the bills. Use it to list all the invoices you have sent them and include a total. You would not use this spreadsheet if you paid for your goods at the time of purchase – eg. Use this spreadsheet to record all the invoices a business issues to a customer who have an account with the business.

Types of trial balance

Ledger balances are segregated into debit balances normal balance and credit balances. Asset and expense accounts appear on the debit side of the trial balance whereas liabilities, capital and income accounts appear on the credit side. The purpose of a trial balance is to verify the accuracy of the financial records by ensuring that the total debits equal the total credits.

Related AccountingTools Courses

- Without it, you risk basing your statements on incomplete or inaccurate data.

- Another way to find an error is to take the difference between the two totals and divide by nine.

- The accounts you use for categorizing transactions are listed in your chart of accounts.

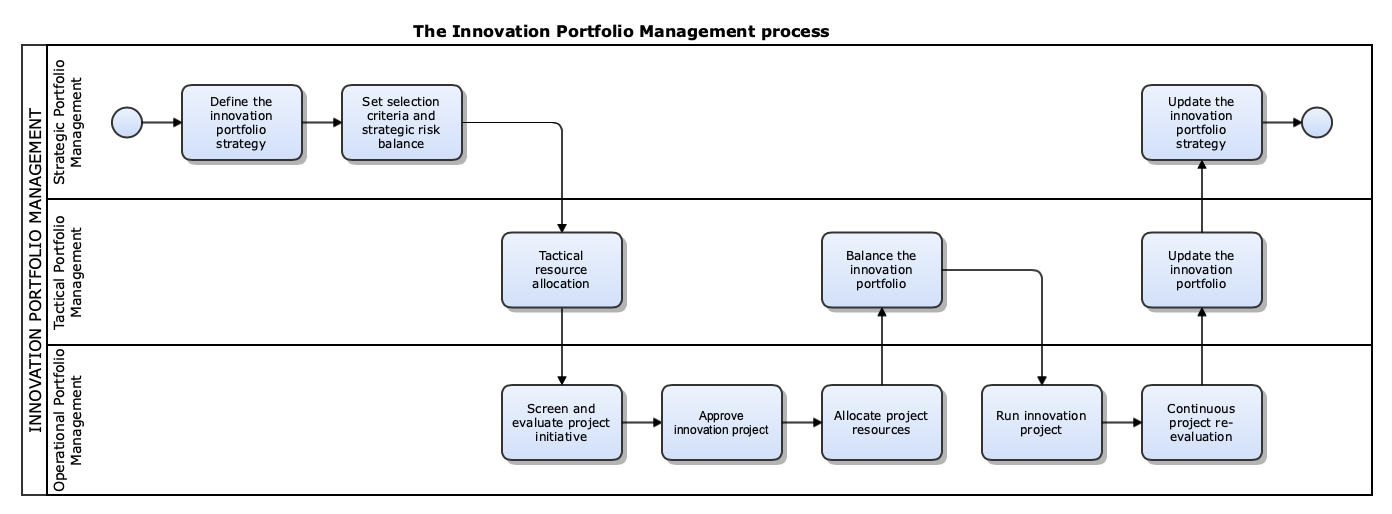

- As a comparison tool, the following table shows an unadjusted trial balance vs. adjusted trial balance and post-closing trial balance.

- This trial balance example includes all the balance sheet items first, followed by the profit and loss account.

Trial Balance has a tabular format that shows details of all ledger balances in one place. It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period. The trial balance shows the list of all the accounts with both debit and credit balances in one place and helps analyze the position and transactions entered into during such a period. A trial balance ensures debits equal credits to verify accounting accuracy and identify errors before preparing financial statements.

Tax and Accounting

Once the adjusted trial balance is made, it is used to prepare financial statements. But if there’s a difference in the totals, there could be mistakes to fix. Trial balances are also a useful foundation when preparing your financial statements. • Implement systematic error-checking by double-checking data entry, verifying source information, and using accounting software to prevent common mistakes like transcription errors and misclassifications. Note that for this step, we are considering our trial balance to be unadjusted.

How many errors are in the trial balance?

- From the above two examples, we have seen that both debit and credit side balances are the same in the trial balance, indicating no error in posting accounting entries.

- Managing your financial processes can be challenging, especially if you’re the owner of a small to mid-size business.

- This is a critical step in the accounting process, as it helps verify the mathematical accuracy of the books before preparing financial statements.

- It is prepared again after the adjusting entries are posted to ensure that the total debits and credits are still balanced.

- The important thing to remember is that, when you prepare a trial balance, all of the credits and debits should balance out.

- It results in tax and regulatory compliance simplification, error and fraud reduction, better financial controls, and real-time spend visibility for decision-making.

- For instance, if you record a cash receipt as a credit to Cash rather than as a debit, the error will be reflected in your trial balance.

In the accounting cycle, preparing the trial balance comes right after posting journal entries to the ledger’s accounts, and just before preparing the https://vanasadam.wp-dev.we.ee/2024/01/08/get-help-with-bookkeeping-accounting-smoker-and-3/ financial statements. A trial balance is a financial statement that records the final balances of ledger accounts at the end of a financial year. It is prepared to ensure all bookkeeping system entries are accurate and to help identify accounting errors. If the totals do not match, it indicates a problem that must be recognised and rectified. A trial balance is created after all financial transactions are posted to the journals and summarised on the ledger statements. It helps to locate errors in the journal or ledger and detect mathematical mistakes in the double-entry accounting system.

Under this system, every transaction is recorded as a debit and a credit and must be balanced. The trial balance also provides a valuable tool for identifying errors in the ledger. If the debit and credit column totals do not match, this can indicate that some errors need to be corrected. Preparing a trial balance ensures that the debits equal the credits in the ledger, which means that the books are balanced. If the trial balance doesn’t balance, it indicates that errors in the ledger must be corrected.

Understanding The Normal Balance of an Account

- With Financial Cents, you can track every client task and project in one place, set and monitor deadlines to ensure nothing is missed, and automate client reminders to save time on follow-ups.

- If the totals agree, it indicates arithmetical accuracy, but it does not guarantee that all errors have been avoided.

- At the bottom of the trial balance report document, the Debit and Credit column totals are presented.

- The total of the debit column must be exactly equal to the total of the credit column.

- A principle error occurs when a transaction is recorded in violation of generally accepted accounting principles (GAAP) or other established accounting rules.

- In other words, a trial balance shows a summary of how much Cash, Accounts Receivable, Supplies, and all other accounts the company has after the posting process.

You’ll need an understanding of accrual accounting to know what to adjust for but once you get the hang of it, you’ll see that a lot of the adjusting entries are similar. It might make more sense if we look at an example of a trial balance or TB as accountants call it. This example we have made up is for our fictitious company Busy Bee Bakery. After the closing entries are done and the year is over, we call the trial balance the post-closing trial balance.

This ensures that all accounts reflect accurate balances, allowing for the preparation of financial statements. Unadjusted trial balances list all ending balances of accounts from general ledgers prior to any adjusting entries. They provide a what is a trial balance preliminary check on ledger balances to determine if any mathematical errors need to be corrected. Unadjusted trial balance reports are created after journal entries have been posted to the general ledger.

Finally, if some adjusting entries were entered, it must be reflected on a trial balance. In this case, it should show the figures before the adjustment, the adjusting entry, and the balances after the adjustment. So, even though adjustments are made in the software, the trial balance report will simply be called Trial Balance.